Full article with thanks to: moneydonut.co.uk/blog/21/09/sole-trader-or-limited-company-what-form-should-your-business-take Sole trader or limited company? What form should your business take? COVID-19 helped to push UK business start-up figures to new heights in 2020. According to the Centre for Entrepreneurs, annual year-on-year UK business formations in 2020 rocketed by 13% to 772,002. A key decision when starting a business is which legal structure should you choose when registering. The three most common options are sole trader, limited company and ordinary business partnership, although most people become a sole trader. Sole traders make up about 59% (3.5 million) of the total UK business population of 5.9 million. They include many freelancers, contractors and agency workers. Ordinary business partnership members make up about 7% (405,000) of the UK business population. Basically, these are sole traders who go into business together. The UK also has about two million (34%) active private limited companies. So, why do so …

Which Taxes Applies To Your Business

Full article with thanks to: unbiased.co.uk/life/small-business/business-tax#introduction Introduction to small business tax Your business may have to pay a number of different taxes, such as: corporation tax income tax VAT business rates Employers’ National Insurance contributions capital gains tax What tax your business pays will depend on how it’s set up, whether or not you have employees, and other factors such as your business assets and premises. Primarily, your business will be taxed on its profits (the net amount of money it makes after losses and expenses). How this happens will depend on its structure. Sole traders pay income tax, as do partnerships (with partners submitting separate tax returns), and also Employees’ National Insurance contributions. Limited companies pay corporation tax. You may also have to pay business rates on your premises. If you supply VAT-able goods or services, and your taxable turnover is above a certain limit (currently £85,000) then you will need to register for VAT. …

Is Free Business Software Good or Bad For Your Small Business?

Are you looking for creative and free business software for your small business? Learn if free software would benefit your small business or not. Full article with thanks to: techdonut.co.uk/business-software/essential-business-software/free-business-software Free business software isn’t always the second best. In fact, some of the best software is free, enabling your business to benefit from up to date, highly capable applications without paying a penny. Types of free business software The easiest way to find free business software is to look online. It tends to fall into one of four categories: Freeware. Freeware is available at no cost and with no restrictions. Freeware tends to be simple software designed to perform one or two tasks. Free trials. Previously known as ‘shareware’, free trials enable anyone to try out an app for a limited period of time, after which a fee must be paid for continued use. Vendors may also choose to disable certain features …

Guide On Payroll For Your Business

This brief article will give you a better understanding of payroll. This guide on payroll will help you to understand what you need to learn and what’s relevant for your small business. Full article with thanks to: unbiased.co.uk/life/small-business/handling-your-payroll If you employ any staff, or plan to do so, you’ll need a payroll. Many accounting firms can provide this vital function for you, but it’s still important to have a good grasp of how payroll works. Whether you run your payroll internally or outsource it, here’s a simple breakdown of the key things you need to know. This article covers: What is payroll? How do you set up payroll? How much should you pay your employees? Pensions & benefits and other payroll deductions Tax reporting (PAYE) via payroll How to run your payroll You can also talk to your accountant about your best options for payroll. What is payroll? Technically, your payroll is …

What is the Advantage of a Partnership Agreement?

Want to start a business and are unsure what business type to go for? Are you thinking about starting a partnership agreement instead of being a Sole Trader or Limited Company? Before you do so, take a look at the pros and cons of starting a partnership agreement. Full article with thanks to: bhwsolicitors.com/news/importance-partnership-agreement The principal law governing partnerships is set out in the Partnership Act 1890 (the “Act”) which defines a partnership as “the relation which exists between persons carrying on a business in common with a view to profit” (section 1 of the Act). The question of whether a partnership exists or not is therefore a matter of fact (not necessarily agreement). It is therefore not something that the parties can simply determine for themselves. While the relationship can be governed by a written partnership agreement, the essence of a partnership is the continuing relationship between two or …

Small Business Advice: Updating Your Business Website

One of the top small business advice. What I constantly share with my clients is that regularly updating their business website is the best way forward. The heart and soul of a small business should be its website – it’s the ‘place’ that any potential customer can reach without any restriction. Full article with thanks to: www.moneydonut.co.uk/news/out-of-date-websites-are-losing-money-for-small-firms A new study has found that shoppers spend 54% less with small businesses that have not updated their websites compared to those that have. The research, conducted by Censuswide for Yell, polled business owners and consumers for their views on the importance of websites. In addition, Yell analysed more than one million SME websites. The results show that many businesses are neglecting to update their websites, with the average site last updated 15 months ago. The data suggests that this could have a direct impact on revenue from online sales, with the study finding that consumers spend …

Small Business Support: Hiring for The First Time

It’s not easy to hire someone – often you don’t know them and it can take a while to really learn if they’re a right fit for your business. It’s a risk. But having an understanding of hiring can make the process a lot easier and can actually help you find the best-suited person for you and your business. With our small business support, we can help you find the right staff for your business or you can use our PAYG virtual admin services. With full credit to: www.starlingbank.com/resources/business-guides/how-to-employ-someone-for-the-first-time Hiring your first employee is a big financial (and emotional) commitment, but it’s also exciting that your business has grown big enough to create a job opportunity. What started as your dream has now become a growing business. It’s no longer just you. Work in your business can potentially now go on even if you’re not there. You’re also in a …

What is IR35 and is it likely to affect your business?

Full article with thanks to https://www.starlingbank.com/blog/what-is-ir35-and-how-to-prepare/ If you’re a freelance contractor working for an end client, you should be aware of the IR35 tax regulation, commonly known as the ‘off-payroll working rules’. New rules around IR35 come into effect on 6 April 2021, after a delay due to the coronavirus pandemic. The government has said that the idea behind IR35 is, “to ensure that people working like employees, but through their own limited company, pay broadly the same tax as individuals who are employed directly.” The new rules bring sections of the private sector in line with the public sector. Does IR35 affect me? Before 6 April 2021, a self-employed person who provided services to clients in the private sector via their own limited company, known as a Personal Services Company (PSC), could decide their own tax status and bill them through that limited company. If the end client was in the public …

Finding an accountant

Full article with thanks to https://www.starlingbank.com/resources/business-guides/finding-an-accountant-for-your-business/ If your business is taking off and you find yourself spending too much time figuring out financial admin, it might be a good idea to hire an accountant. A good accountant can be a real asset to you – they can help free up your time. Here we cover the basics of what you should consider before hiring an accountant. One thing before we start – remember that if you’re a Starling business customer, you could also try out our Business Toolkit, with all kinds of bells and whistles for accountancy and VAT. What does an accountant do? An accountant can help you comply with your tax and Companies House obligations by filing the appropriate forms and accounts. A good accountant will be able to offer tax advice so that you’ll have more money to reinvest in your business. The best sort of accountants will …

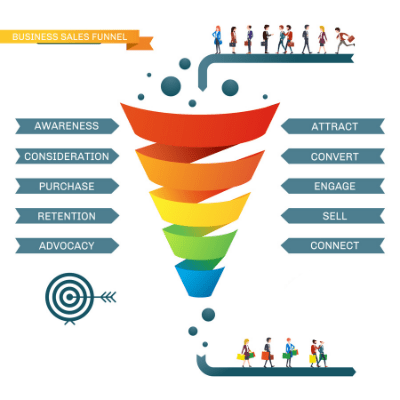

The Beginner’s Guide to a Sales Funnel

Full article with thanks to https://www.mailmunch.com/blog/sales-funnel/ The Beginner’s Guide to a Sales Funnel. Everyone who has an online business needs to create a sales funnel in order to convert their website visitors into paying customers. If you fail to do that, you will hardly make any money. Your primary goal with your sales funnel is to move people from one stage to another until they are ready to purchase. In this blog post, we’ll explain how to create a sales funnel for your online business. What is a Sales Funnel? A sales funnel is a marketing concept that maps out the journey a customer goes through when making any kind of purchase. The model uses a funnel as an analogy because a large number of potential customers may begin at the top-end of the sales process, but only a fraction of these people actually end up making a purchase. As …